When it comes to paying off your student loans, the struggle is beyond real. It can feel straight-up life-crushing and maybe even impossible. But hey—you aren’t alone under this weight. There are 44 million student loan borrowers in America who, put together, owe around $1.6 trillion in student loan debt.1, 2

If you’re feeling burdened by this debt, you may be searching for a way to pause those payments—and seeing a few options. But student loan deferment vs forbearance—what’s the difference? But don’t jump into this temporary relief just yet. First, you should know more about how deferment and forbearance work—plus other options you have if you’re feeling completely overwhelmed by your student loans.

Before we dive in, let’s give a quick call out: Under the current Coronavirus Aid, Relief, and Economic Security Act (aka the CARES Act), payments for federally owned student loans are suspended until September 30, 2021, with a 0% interest rate during that time. So, this gives you two options. You can pause paying if your finances are tight. Or you can keep paying because anything you put toward those loans right now will go straight to the principal (the original amount you borrowed) instead of the interest!

Okay, now back to our regularly scheduled content:

Deferment vs. Forbearance

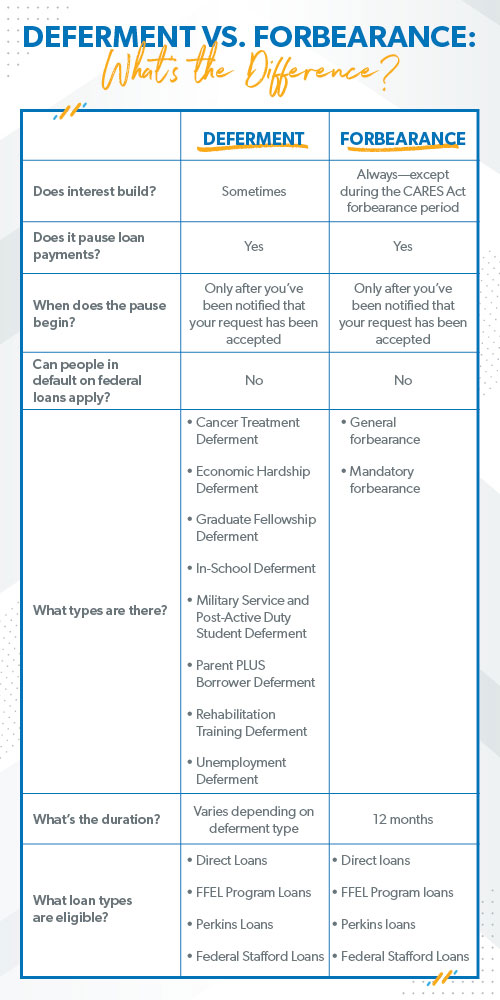

So, both student loan deferments and forbearances put a pause on payments. You can’t apply for either if you’re in default on your federal student loans. And—this is important—you have to keep making your regular payments until you get official word that your deferment or forbearance has been approved. You can’t just stop paying after you fill out the paper work, or your loans will become delinquent, meaning you missed a payment. If you miss several payments, you could go into default, meaning you broke the loan agreement and may have to suffer some pretty serious consequences.

One of the main differences is what happens to your interest during the payment pause. And it’s one heck of a difference, as you’ll find out. Let’s look deeper into how student loan deferments and forbearances are similar and different:

What Is Deferment?

Deferment is a way to stop paying on your student loans—temporarily. People who are in school, currently unemployed, in the military, getting cancer treatments, or having financial hardship (that means you can’t afford to pay your bills—and you can prove it) are most likely to qualify. The length of a deferment depends on the type. For example, students enrolled in eligible colleges and programs may qualify for an In-School Deferment for the entire time they’re enrolled and possibly up to six months after they leave. And an Economic Hardship Deferment can last up to three years.

When you get a deferment for subsidized federal student loans or Perkins loans, you don’t have to pay for the interest, and more interest doesn’t build up. But for other types of student loans, the interest does build up during deferment. That means the loan balance (what you owe) will be higher when the deferment time period is over.

What Is Forbearance?

There are two types of forbearance: general and mandatory. In a general forbearance, you make a case for why you can’t keep up with the payments, and then the lender decides to approve or deny your request. You can apply if you have financial difficulties, medical expenses, change in employment, or other reasons you can’t cover your loan payments. Just submit your general forbearance request, and the loan provider will review it. But keep in mind, only direct loans, Federal Family Education (FFEL) Program loans, and Perkins loans are eligible for general forbearance.

Ready to get rid of your student loans once and for all? Get our guide.

Mandatory forbearances are, well, mandatory. (The title kind of gave that one away.) Here’s what that means: If you qualify, the loan provider has to accept your request. So, what usually qualifies?

- You have a direct loan or FFEL Program loan.

- You’re serving with AmeriCorps, working in your medical or dental internship or residency, or working as an activated member of the National Guard.

- The total amount you owe every month for all your federal student loans is 20% or more of your total monthly income.3

With either type of forbearance, your payment is put on hold, but the loan continues to build up interest. That interest just piles onto the balance. (Yikes!) In other words, the amount you owe increases. Sometimes a lot. You might be hitting the pause button on payments, but your balance is getting bigger the whole time. It’s like taking a pause on doing the laundry. Yeah, you get a break for the moment, but that pile of dirty clothes is growing larger every day. Only this is much worse because it’s debt.

Private Student Loan Forbearance

If you have private student loans, you can’t apply for deferment or forbearance. You’d have to contact the lender to talk through your situation and see if they’d give you break in making payments. Even if they do, though, expect your interest to build up during the break. You’d still have to pay your entire loan amount (plus all the interest) in full.

Is Deferment or Forbearance Right for Me?

When you put your student loans into deferment or forbearance, you risk losing control of the debt. You may feel some relief in the moment, but the debt isn’t going away. In all cases of forbearance and some cases of deferment, the debt actually gets bigger because the interest keeps piling up. You aren’t solving a problem. You’re delaying it and letting it grow.

The only time you should even think about pausing student loan payments is if you’re in a financial situation where you can’t cover your Four Walls: food, utilities, shelter and transportation. You don’t pay Perkins if you can’t feed your family. But if things don’t come to that, keep fighting the good fight of paying off these loans. Yes, it’s tough. But you’re tougher.

Alternative Repayment Plans

If you’re struggling with student loan debt, deferment and forbearance aren’t your only options. (Thank goodness, since they’re more harmful than helpful.) Let’s look at what else is out there.

Student Loan Consolidation

Student loan consolidation takes all your different federal student loans and turns them into one loan. It’s the only form of debt consolidation we recommend—with caution.

If you’ve got multiple federal loans, consolidating can help you focus on one monthly payment. It can also trade any variable interest rates for fixed (which is super nice!). But warning: Consolidating usually extends the length of your loan, and it won’t give you a lower overall interest rate (just the average of your current rates). So, if you do choose to consolidate your federal student loans, you’ll need to pay more than the minimum payment to keep from spending a ton more in interest over time.

Student Loan Refinancing

So, like we said before, you can’t defer or forbear private student loans (at least not the traditional way through the government). But refinancing is one way to help you get on top of your private loans.

Student loan refinancing is done through a private lender. They pay off your old student loans and give you a new loan with new terms. By refinancing for a lower rate, you’ll pay less interest on your loan every month, save money, and use those savings to get your debt down to zero quicker.

But you should only refinance your student loans if:

- It doesn’t cost you anything to refinance.

- You can get a lower overall interest rate.

- You can get a fixed rate instead of a variable rate.

- You don’t sign up for a longer repayment period.

- You won’t lose motivation to crush your debt fast!

If it doesn’t check off all those boxes, it’s a no-go. And you’ll need a trustworthy lender (one who won’t try to get you into more debt or charge you to refinance).

Income-Driven Repayment Plan

There’s also something called an income-driven repayment plan. If you qualify, the monthly payment on just one eligible federal student loan is adjusted based on your income, and whatever you don’t pay off after 20 years might be forgiven. Might. But be careful—those loan forgiveness rules change up quicker than you can say “regret.” Also, paying on a loan that long means you’re actually spending thousands more than what you borrowed in the first place. Why? Because the interest rates are stupid high. And let’s be honest: 20 years is just too freaking long to be in debt.

Listen. We know student loans—and any debt for that matter—can start to feel like a weight that’s squeezing the very life out of you. And a break from payments might seem like a temporary quick fix. But instead of trying to delay the problem, get mad at it! Get mad enough to pay off all your debt as quickly as you can, so you don’t feel weighed down anymore. Make freedom from debt your reality.

It is possible. And you can do it!

If you’re ready to actually do something about your student loan debt, check out our Guide to Getting Rid of Your Student Loans. Find out what you need to know about relief options, forgiveness and how to pay off your loans fast!

Read the full article here